As a lighting solutions provider of international building projects, Patrick has been working with Architects, Planners and Real Estate Owners for most of his professional life. At some point, it just made sense to use his Swiss construction business experience, to work with the same network of people and to do more than just lighting – so he decided to get involved in the real estate market.

After an extensive due diligence phase, Patrick, together with his cousin as a co-investor, invested into his first residential real estate development in the city of Basel in 2015. The project was a big success. Patrick was then repeatedly asked by friends and business partners for a possibility of co-investing. To that end and inspired by Michael’s club deals for venture capital, he developed a club deal structure together with specialists, designed specifically for real estate transactions.

The exit of his first project successfully took place at the end of 2017. In the meantime, two new projects were started and are currently being developed, one of which is already in construction, the second project is due to start in the spring of 2019.

Current investors appreciate these professional business cases, which deliver above-average returns when benchmarked against other real estate investments in Switzerland.

Historically low interest rates as well as a solid potential for renewal and concentration of existing living space will continue to ensure a robust demand for real estate in selected areas in the future.

How we do it and why we are successful

We believe, that the most important success factor is, that we stick to focus areas and project criteria.

It is all about Focus

We are focusing on micro-locations, which show a lack of availability of new and contemporary living spaces. Geographically, our current focus lies in the Basel area, one of the world’s leading life-science hubs and third largest city of Switzerland. Until recently, its population stagnated for many years and so did investments into new real estate developments. This fact, as well as the forecast of a growing population is generating a demand for new real estate in this area. Thus, in comparison to other Swiss cities, the demand for home ownership in Basel continues to be strong.

Other locations of interest are neighborhoods, which undergo significant demographical changes.

We e also take a great interest in neighborhoods, which are «up and coming» and therefore have a potential for upselling, compared to the existing standard of living and pricing.

You will find project examples under “Track Record” below.

Project Criteria:

Location

- Switzerland only: our focus is on larger cities and specific agglomerations, primarily in German-speaking Switzerland, that forecast a growing population

- We like areas with low availability ratios

- Proximity to public transportation is another “must”

- Above all – the current property must show a significant market potential for adding value

Project Size

- Medium-size volume, ranging from 10 to 40 living units, which allow an efficient and economical construction process. There is a far greater number of construction companies, that are capable to manage these projects, compared to large projects (i.e. therefore there is more capacity and more competition).

- Because of the lower quantity of units offered, the selling risk is smaller.

- This size is an interesting niche for real estate investors, since it typically is too big for private investors, but at the same time it’s too small for large institutional investors (i.e. pension funds)

Architecture

- Together with our project partners, we are working with state of the art processes and create living spaces, that are tailored to the exact needs of our target groups. However, we do not like architectural experiments, which is why we are working with proven and efficient technical concepts.

- Although the structure of our buildings is standardized, the floor plans as well as the materials of the interiors of the apartments and houses generally can be individualized to a certain degree, according to the needs of the buyers. This is supporting the sales process and is adding value at the same time.

Team

- In our project teams, we work with highly experienced professionals. All of them have a long history with a strong track record of successfully completed property developments. Each project has its own individual project team.

Our work includes an ongoing search for the ideal property with the right potential to invest in. It is a lengthy and time-consuming process, in which we are actively using our personal professional network. In the process, we are screening countless sites and properties, until we decide to further examine a specific site or even start with our due diligence. At this early stage, we are looking at various factors within the micro-location, such as:

- Proximity and frequency of public transportation;

- Access to nearby infrastructure like shops, pharmacy or a bank;

- Population: growth, age structure, family structure;

- Ratio of empty apartments on offer;

- Structure and pricing of apartments on offer;

- New projects, that are seeking for building permission.

We strongly believe, that it is the quality of a thorough due diligence, that will later have a significant impact on the economic success of a project. The result of our due dilligence is the basis that we use, for the actual definition of our future product offering and its positioning in the market.

Subsequently, we see our due diligence as being the first crucial step in risk management.

Risk Management

- During the evaluation phase and due diligence process, we are using Switzerland’s largest databases as well as various local resources, in order to evaluate the demand for each area and specific site. There are three dimensions in the due diligence process, that we are looking at: technical, economic and legal.

- Our project teams work with state of the art project management tools, that allow us to monitor any deviation in costs or on the timeline

- For each project, we have a steering committee, that is meeting on a regular basis and that is receiving project reports from the team for every meeting

- Throughout the whole process, from planning to execution, we only work with very experienced professionals

- We know the construction companies and suppliers – they must have an excellent reputation in the market as well as a solid financial background

- For the financing of our projects, we only work with reputable banks and financial institutions

- Before going to the market, we benchmark and check our selling prices with some of the leading local banks, since they will be giving the mortgages to our future buyers

- We only start construction, once a minimum of 1/3 of the units have been sold

- We only sell to buyers, who provide us with a bank guarantee for 100% of the sales value

We invest our own money

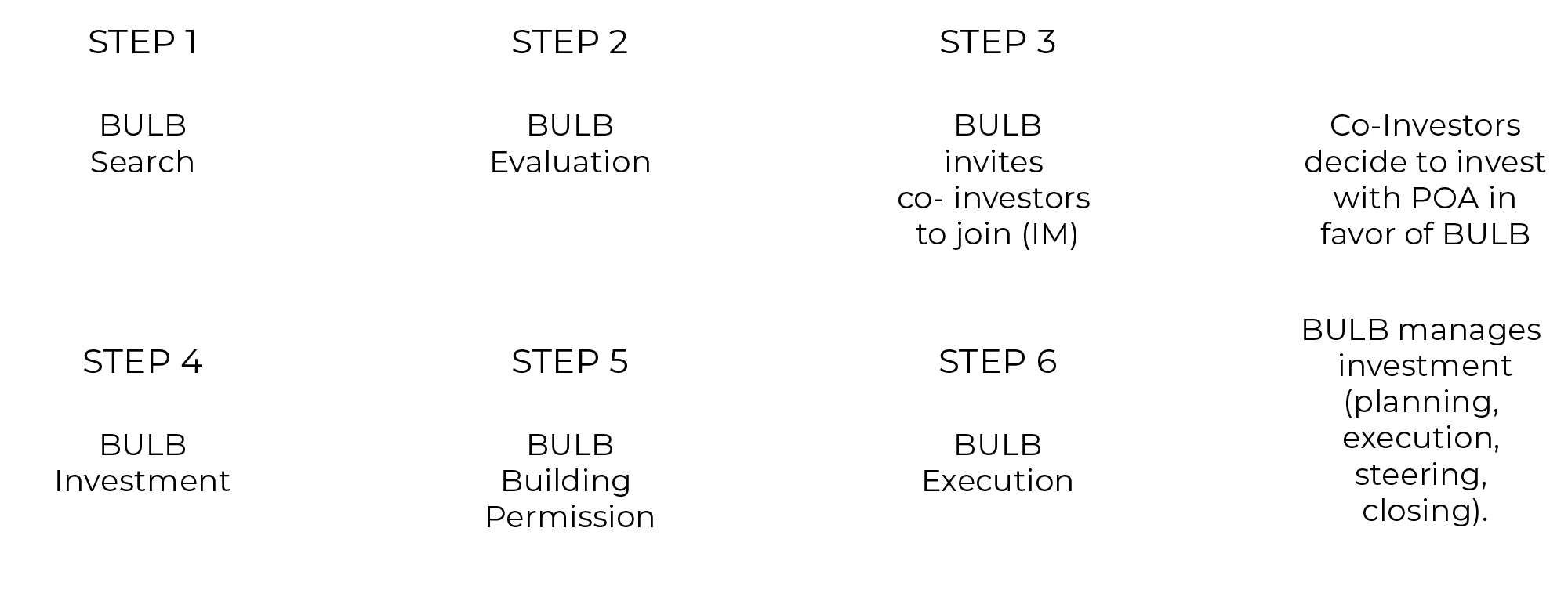

The investment process is clear and transparent. We invest our own money and invite co-investors to join us under the same terms and conditions.

Track Record

We are professional real estate developers and active investors. Since 2015, we invested in three real estate developments with one successful exit in 2017 as well as two new developments with exits to come in 2020 and 2021.

Johannshof Residence

Basel St. Johann

- background: transform a commercial space

into residential living space and increase volume - added value: develop 32 apartments with versatile

floor plans, that allow different types of housing, sold

at a medium-level pricing

- Investment beginning 2015

- Closing end of 2017

- Sales value CHF 29 MM

Website: johannshof.ch

Inzlingerstrasse

Riehen

- background: turn a plot with a 1970s villa into a

multiple-housing concept - added vaulue: develop 8 semi-detached houses with individual as well as communal gardens, sold at a medium-level-pricing

- Investment 2017

- Sales value CHF 16 MM

Website: inzlingerstrasse.ch

Batterieweg

Basel Bruderholz

- background: transform a property with

a 20th century house in a park-like

environment into a space of luxury

apartments - added value: develop 3 residential

building with a total of 18 apartments,

that are highly customisable, including

above-average large individual terraces

for each unit

- Investment 2017

- Sales value CHF 28 MM

Contact

Patrick Dreyfus, Board Member and Managing Partner

Phone: +41 61 568 8203

Mobile: +41 79 415 8393

Email: pd@bulbcapital.com